PDX Benefits LLC

No-Cost, No-Hassle Business Solutions—We Shop and Compare So You Don’t Have To.

A Business Services Broker plays a crucial role in helping companies manage processes and handle various administrative tasks while working with multiple advisors.

They help you find the right advisors that feel like partners and are thinking about whats for you and not thinking of you as a task on a list.

Our services streamline and enhance business operations, ensuring everything runs smoothly and efficiently.

By taking on these responsibilities, we allow businesses to focus on their core activities without getting overwhelmed by payroll and administrative duties.

For example, if you have an audit coming up, we can provide a list of items you need to collect and communicate with different agencies to gather that information.

Don't worry, we can help!

We serve as both a Broker and a Coordinator

Business Services

Concierge

Business Advisor Coordinator

Independent

Payroll Broker

Ongoing support to optimize your current services.

Identifying hidden fees and extra costs.

Regularly comparing market rates to prevent overspending.

Finding solutions to improve efficiency and reduce operational headaches.

Regular check-ins with your advisor

Monthly updates on advisor activity

Facilitating collaboration between advisors

Managing incoming opportunities and support requests

Customized Payroll Solutions: Tailored, accurate, and timely payroll services.

Compliance Assurance:

Ensures compliance with tax and employment regulations.

Integration Support:

We integrate payroll systems with business software.

Outsource common tasks to experts so your

company can focus on growing while we handle the rest.

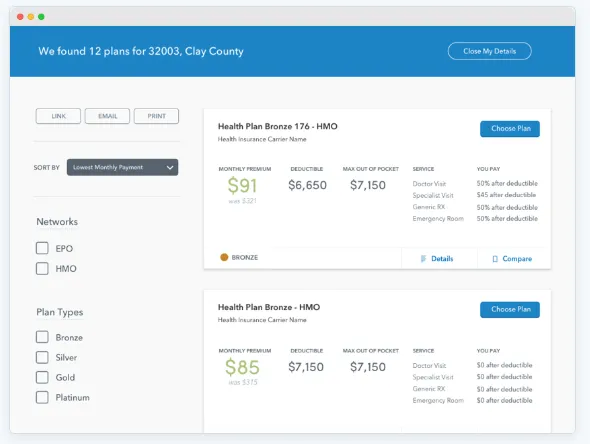

Easy plan shopping

Browse and compare plans based on what matters to you most.

Outsourced Services PDX Benefits Accesses

1. Accounting & Bookkeeping

Payroll, tax preparation, financial reporting

3. IT Services

Network management, cybersecurity,

help desk, software development

5. Administrative Support

Virtual assistants, data entry, scheduling

7. Legal Services

Contract management, compliance, intellectual property

9. Facilities Management

Cleaning, maintenance, security

2. Human Resources (HR)

Recruitment, onboarding, benefits administration,

employee training

4. Marketing & Advertising

Social media management, SEO, content creation, branding

6. Sales

Lead generation, telemarketing, sales management

8. Creative Services

Graphic design, video production, website design

10. Compliance & Risk Management

Regulatory compliance, insurance, audits

James has been great to us with and he is quick to use his connections to

benefit those who he works with!

Ukaia Rogers • Country Financial

James is the best. If you need a consultant that truly cares about your best

interests, he is your man!

Josh Boer • River City Roofing

PDX Benefits is the must have resource for all of your HR Benefits and

solution needs! Highly recommended.

Eric Bell • Shift In Marketing

7 Immediate Pain Points Our New Clients Get Resolved

1. Relying on an individual office manager or one decision maker

2. Business decisions are based on limited cost and accessibility

3. Rely on looking for business and not receiving business

4. Feel like they are always working on the business

5. Hard time delegating jobs, clients, or management

6. Individuals Responsible for HR and Accounting

7. Never enough help or constant employee turnover

These questions help eliminate money from

being left on the table.

Are you facing business challenges but lack the time to research or negotiate better deals?

Feeling overwhelmed managing and communicating with advisors and service providers?

Are managing opportunities and support requests becoming overwhelming, even though it’s your service providers’ responsibility?

Do you want vendor options compared and managed directly without additional administrative fees?

Wish you could have regular reports from your advisors?

Could ongoing support to optimize your services, identify hidden fees, and compare market rates reduce operational headaches help your business?

Tired of handling calls from service providers or dealing with support issues, but don’t have time to wait on hold?

Would you benefit from a team guiding you through every step of the process, from identifying pain points to implementing new solutions?

#1 Goal:

Build A Partnership With You

Three areas that are always on top of mind when developing a plan, process, or solution.

Your Values and Beliefs:

- Strong commitment to your community.

- Valuing hard work, reliability, and craftsmanship.

- Creating job opportunities within your business and community.

- Emphasizing building your legacy and creating a sustainable business

Your Goals and Aspirations:

- Growing your business sustainably while maintaining quality.

- Streamlining operations to increase efficiency and profitability.

- Providing excellent service and building a strong reputation.

- Creating a positive and supportive work environment for your employees.

Actively Engaged on your Behalf:

- Promoting your business when engaging with local business networks and associations.

- Continuously researching and learning from industry experts with your business in mind.

- Investigating new tools and technologies as they emerge and sharing that knowledge with you.

JAMES RUSSELL

My goal is to help everyone overcome challenges and succeed.

Through workshops and practical tips, I aim to improve business operations, focusing on areas like efficiency, HR, and finances.

I also connect business owners with useful resources and industry experts.

I understand the unique challenges business owners face and provide advice that fits their needs.

I help businesses grow by giving them custom solutions to make their operations more efficient and profitable.

Former Special Education teacher with over a decade of experience turned education consultant, specializing in helping businesses find the right solutions to fit their unique needs. After transitioning to the private sector, I saw how much businesses needed support in areas they didn't have time to address.

I started connecting with companies to understand their challenges and match them with the best vendors—always prioritizing what's best for the business, not the vendor. I'm passionate about helping companies attract and retain top talent with more thoughtful compensation options, all while simplifying operations and cutting costs to drive growth. Let's work together to make your business thrive!

Client’s Financial Impact (ROI)

Key Areas of Improvement and Impact on Revenue

Operational Efficiency

Impact: 10% increase in operational efficiency.

Improved Recruitment and Retention

Impact: 5% increase in project quality and client satisfaction.

Enhanced Team Dynamics

Impact: 5% increase in overall productivity.

Strategic Planning and Scaling

Impact: 10% increase in revenue due to better strategic planning and scaling.

TESTIMONIALS

What others are saying

Who We Like To Talk To

HR Managers

Operations Managers

Head Controller

business owners

Managing Director

Superintendent

Industries

Construction

Manufacturers

Suppliers

Health Clinicians

Auto Industry

Transportation

Educational services

Food industry

Agriculture

Simple Solutions to Solve your

Business Frustrations.

Tackling Project Management, HR Issues, Financial Constraints, and Market Barriers to Drive Efficiency and Success

Operational Challenges:

- Inefficiencies in project management and timelines.

- Difficulty in managing multiple projects simultaneously.

- Lack of streamlined processes for onboarding and training new employees.

- Challenges in organizing supplies and subcontractor relationships.

Service Solution:

Operational Efficiency Audit

Conduct a thorough review of the client’s current operations to identify inefficiencies and areas for improvement.

Spend a detailed session analyzing workflows, processes, and organizational structure.

Present a comprehensive report highlighting inefficiencies and recommended improvements.

$1,497.00

Recruiting and Retaining Key Employees:

- Trouble finding and retaining skilled labor.

- Inadequate HR processes and benefits to attract and keep employees.

- High turnover rates and the associated costs of training new hires.

Service Solution:

Recruitment Strategy Blueprint

Develop a targeted recruitment strategy to attract and hire skilled labor.

Analyze current recruitment practices and identify key areas for improvement.

Provide a customized recruitment plan, including sourcing strategies, job descriptions, and interview techniques.

$1,497.00

Financial Constraints:

- High operational costs and thin profit margins.

- Competition with larger, more established firms.

- Difficulty in breaking into new markets or expanding their client base.

- Need for better marketing and visibility to attract clients.

Service Solution:

Vision and Strategic Planning Workshop

Facilitate a session to help the client develop a clear vision and strategic plan for growth.

Work with the client to define long-term goals, set strategic objectives, and create a roadmap for success.

Present the strategic plan and outline actionable steps to achieve the defined goals.

$1,497.00

Human Resources Issues:

- Lack of streamlined processes for onboarding and training new employees.

- Cultural issues and team dynamics that affect productivity and morale.

- Trouble finding and retaining skilled labor.

Service Solution:

Team Dynamics and Communication Assessment

Assess team dynamics and communication effectiveness within the organization.

Evaluate current communication practices, team interactions, and cultural alignment.

Deliver a report with insights and recommendations for improving team dynamics and communication.

$1,497.00

PARTNERS

Who We Work With

Get In Touch

Assistance Hours

Mon – Fri 9:00am – 8:00pm

Saturday and Sunday – CLOSED

Facebook

Instagram

LinkedIn